Award-winning PDF software

Disadvantages of Owner Financing Form: What You Should Know

A seller is not required to make up the difference if the seller is foreclosing on the property immediately. You will need to provide the owner with information about the condemned property. The cost of owner financing can be significant. The Costs of Owner Financing for Buyers: Pros and Cons The cost of owning a home with a mortgage can be more than other loan types, but with many caveats. You'll likely pay more rent, as well. You'll also require additional payments and property taxes. This type of loan is not appropriate for every buyer. Some homebuyers may prefer the low interest rates offered by traditional mortgages. Other buyers may need more risk, for example, a home with a lot of equity or a buyer who won't qualify for conventional loans. There are advantages and downsides to both mortgage types. What Are the Benefits of Owner Financing? A homeowner may be able to access larger budgets for an investment property and may be able to make a smaller down payment. Cons of Owner Financing? For buyers, owners may have to pay the seller back over a long period of time. For example, you may have to make a substantial payment at the start of ownership. Sellers may want to buy a home quickly, which may make it difficult to keep your credit score in a favorable range. Also, there may be more time in the year to pay on the loan as well as additional interest costs. Who May Benefits From Owner Financing? Many homebuyers or homeowners with equity may benefit if the owner is paying the mortgage, providing additional money monthly on top of the mortgage payments, and making a down payment that covers the full amount of the mortgage (i.e. with no additional payments). Sellers may also have less risk of having a long property foreclosure after a property is purchased with an owner loan, or of having a lender foreclose on a property (often after a period of ownership, though not always). Lenders that Offer Income-Driven Home Loans Mortgage and debt collection agencies provide income-driven home loan products. They typically offer a lower interest rate than other types of mortgage in order to generate higher profits. Mortgage Agencies Offer Income-Driven Home Loans Mortgage debt collection agencies commonly offer income-driven home loans.

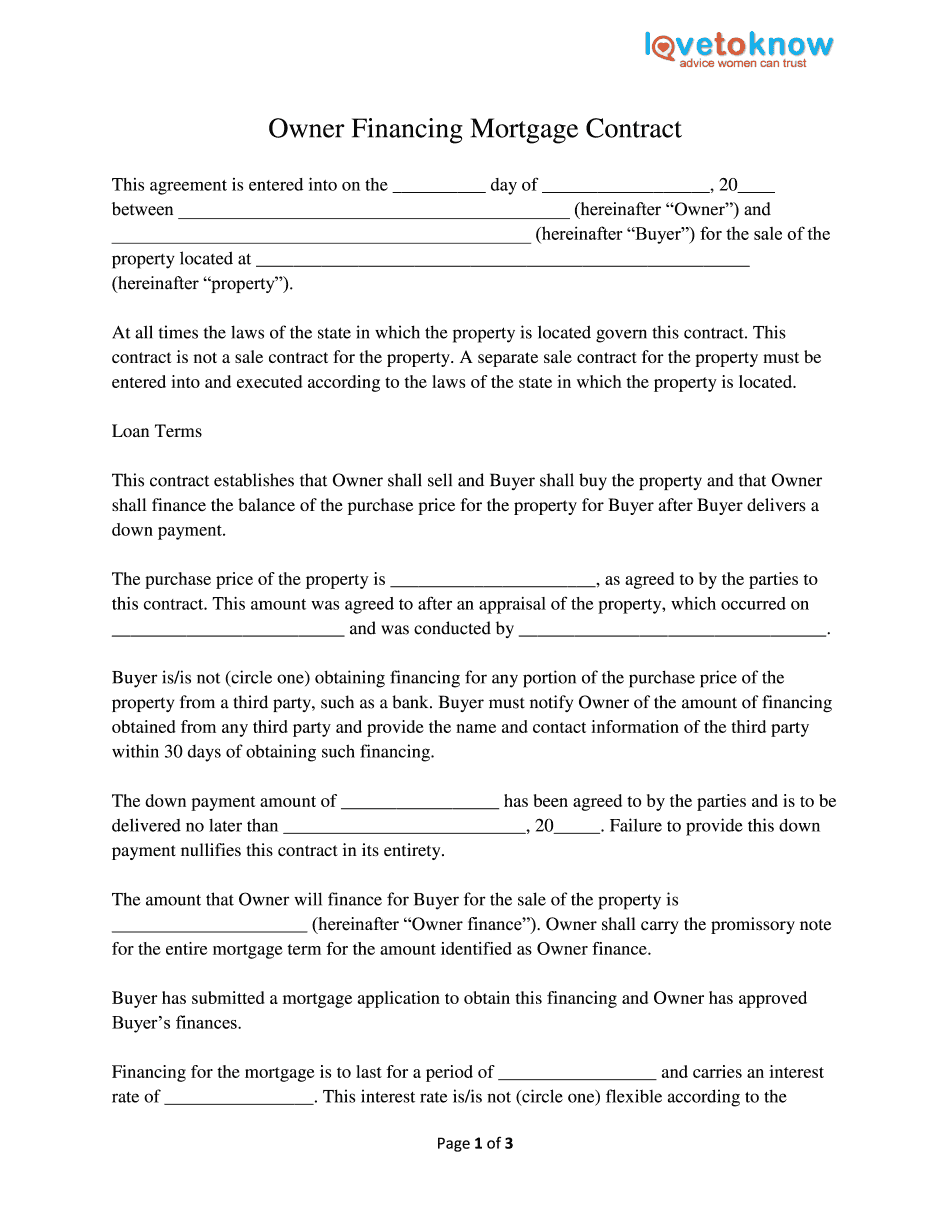

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Owner Financing Mortgage Contract, steer clear of blunders along with furnish it in a timely manner:

How to complete any Owner Financing Mortgage Contract online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Owner Financing Mortgage Contract by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Owner Financing Mortgage Contract from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.