Owner financing is becoming increasingly popular in today's economy due to how difficult obtaining a conventional mortgage has become. In order to qualify for most conventional mortgages, a person must have a certain credit score, employment for a certain number of years, and be able to put 20% down on the property. Additionally, they must hope that the bank comes up with the same appraisal value of the property that everyone else in the equation does, or the loan will fall apart. The fact is, there are so many things that need to go right in order to obtain a loan that many people are turning to an alternative - owner financing. After all, in a free and competitive society, isn't the ability to create new avenues to solve problems the backbone of capitalism? With that in mind, let's answer the question: how does owner financing work? Before we discuss owner financing, let's first explain how a conventional mortgage works. Then, we can explain the differences between a conventional mortgage and owner financing. In a conventional mortgage, a seller agrees to sell a house to a buyer for a price. When the sale is complete, the new buyer obtains a deed to the house. The buyer goes to a bank to obtain a loan for the purchase, using the house as collateral. Should the buyer ever default on the loan, the bank seizes the house and the seller is then paid in full. This loan is known as a mortgage. The buyer will obtain the deed to the house when the sale occurs, along with the mortgage, and will typically pay both principal and interest on the mortgage for the next 15 to 30 years. In a typical owner financing transaction, a seller agrees to sell a house to a buyer for a price....

Award-winning PDF software

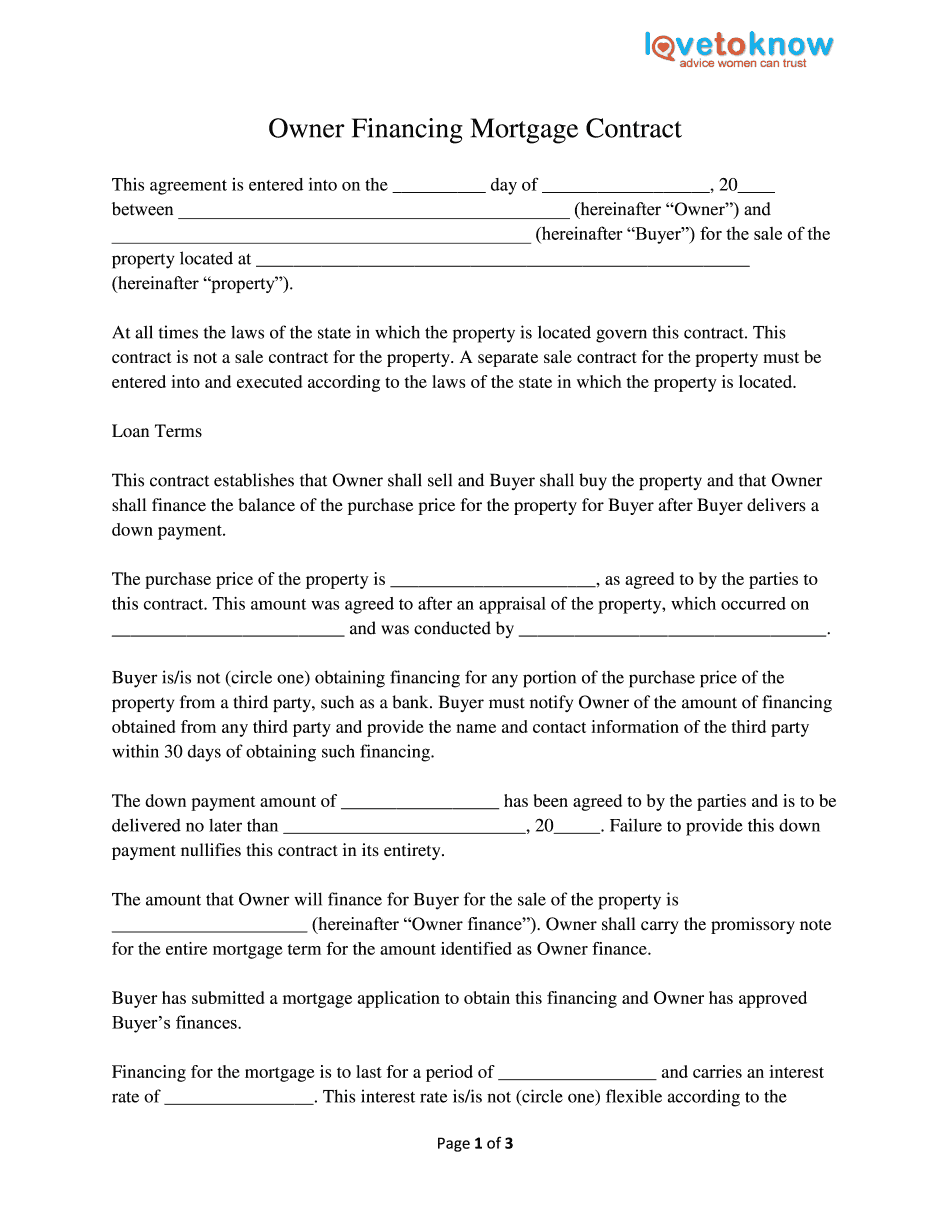

Typical Owner Financing terms Form: What You Should Know

Statement that all information supplied is accurate and complete. 2.) Statement that Seller agrees to cooperate with all inquiries or complaints from buyers or others as provided in the Seller Information Package provided in a separate document. Seller shall be responsible for any costs arising from any false statements or misrepresentations made in this Release. 3.) Notice that the property is located in the state of New Mexico and is subject to the New Mexico Real Estate Appraisal Code, Section 13-2-3, relating to nonpayment. 4.) Statement that Seller is the Owner of the property which is being sold by Seller, including the Mortgage/Joint Powers of Attorney on file and the Title to the property. Seller hereby declares that Seller may represent Seller and Buyer together in the transaction and Seller and Buyer represent that the other party will not act as agent for Seller and Buyer in any case. 5.) Statement of the date, the time, and the place of the closing. 6.) Statement of the estimated amount of closing costs required, if any, and of all other closing costs which would be payable by the Buyer to Seller. 7.) Statement of the number of days, hours, minutes and seconds of the anticipated sale by Seller to Buyer. 8.) Statement that Seller agrees to execute no further documents in support of the Release as provided in the attached materials; but Seller may confirm whether the Release is valid or correct in the records of HUD as provided in HUD's Notice of Error. 9.) Statement that Seller and Buyer and Agent agree to deliver to Buyer or Buyer's agent a copy of the Release signed by both buyers before the purchase is complete and to keep such Release signed on the Buyer's behalf. 10.) Closing, including completion of escrow. 11.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Owner Financing Mortgage Contract, steer clear of blunders along with furnish it in a timely manner:

How to complete any Owner Financing Mortgage Contract online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Owner Financing Mortgage Contract by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Owner Financing Mortgage Contract from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Typical Owner Financing terms