Today on the Ask BP podcast, we're talking about what exactly is seller financing and how it works for both parties. Stay tuned, you're listening to another BiggerPockets Ask BP podcast where you'll hear short direct answers to your biggest real estate questions. Submit your question today on Facebook, Twitter, or the BiggerPockets forums by using the hashtag ask BP. And don't forget to pick up your copy of the ultimate beginner's guide to real estate investing and other great content when you sign up for your free account at BiggerPockets.com. With that, let's get to the show! Hey, what's going on everyone? My name is Brandon and you are listening and/or watching the Ask BP podcast, the show that we bring you every single weekday of the week (does that make sense?) to answer your burning real estate questions. Today's question comes from Tristan from San Antonio, and Tristan asks, "Could you explain how owner financing works from the perspective of both the buyer and the seller?" I like this question a lot because seller financing is a very, very powerful strategy that I've used and love. I think I'm going to use it more and more going forward. I'll explain why in a second, but let me answer your question, Tristan. So, how does seller financing work? For those people who are not familiar with the concept, let me explain that first. When you own a property, you can do a couple of things. You can sell the property and somebody can come and pay you cash for it. Right? They could give you, if you're selling your property for $100,000, they could come and give you $100,000 in cash and buy the property. They could also come and give you a $100,000 loan from the bank. They can go...

Award-winning PDF software

Is Owner Financing a good idea Form: What You Should Know

Jun 17, 2034 — The property owner is also paid on a regular basis; sometimes monthly. Federally Regulated Home Loans: What It Is & How It Works | Bank rate May 04, 2042 — Federally regulated home loans usually allow the bank to extend lower interest rates than if all homeowners were sold the normal way Why Buy a Home From a FHA or VA Home Buying Guide? | AARP Home Ownership & Finance Blog May 17, 2046 — Since the Federal Housing Administration (FHA) and the Veterans Administration (VA) are government-sponsored, not-for-profit mortgage lenders, all their home purchase programs have the same advantages and restrictions. FHA vs VA vs conventional home mortgages | AARP Homeownership & Finance Blog May 11, 2066 — FHA and VA Home loans differ in the way they handle down payments; FHA loans require 1 percent down, while VA loans require 6 percent of the property price, a higher minimum down payment than with FHA. Which Mortgage is Right For Me?: Find Out Here Home Equity Conversion Mortgage Loans Home equity converted mortgage loan is a type of home equity conversion (HELM) loan; they allow home buyers to convert the value of their existing home equity into cash money. · Home equity converted mortgages — also called conventional or FHA-qualified mortgages — are a good alternative for homeowners who often face restrictions for mortgage financing because they're not qualified for conventional mortgages. · Unlike conventional mortgages, home equity converted mortgages come with a lower payment and higher interest rate, and allow the buyer to use their existing home equity. · The loan is not insured by the government and there are now down payments required. How Long Does It Take to Convert Your Home equity?: Find Out Here Loan Forgiveness: How It Works and Why You Should Take Advantage Of It | Bank rate When you sell a house, you have to pay taxes on your house value and any capital gains. But if you decide to buy a home a few years later, the house could be worth less, so you could pay taxes again. When the time comes, you'll pay that amount back to the bank. This is called tax equity.

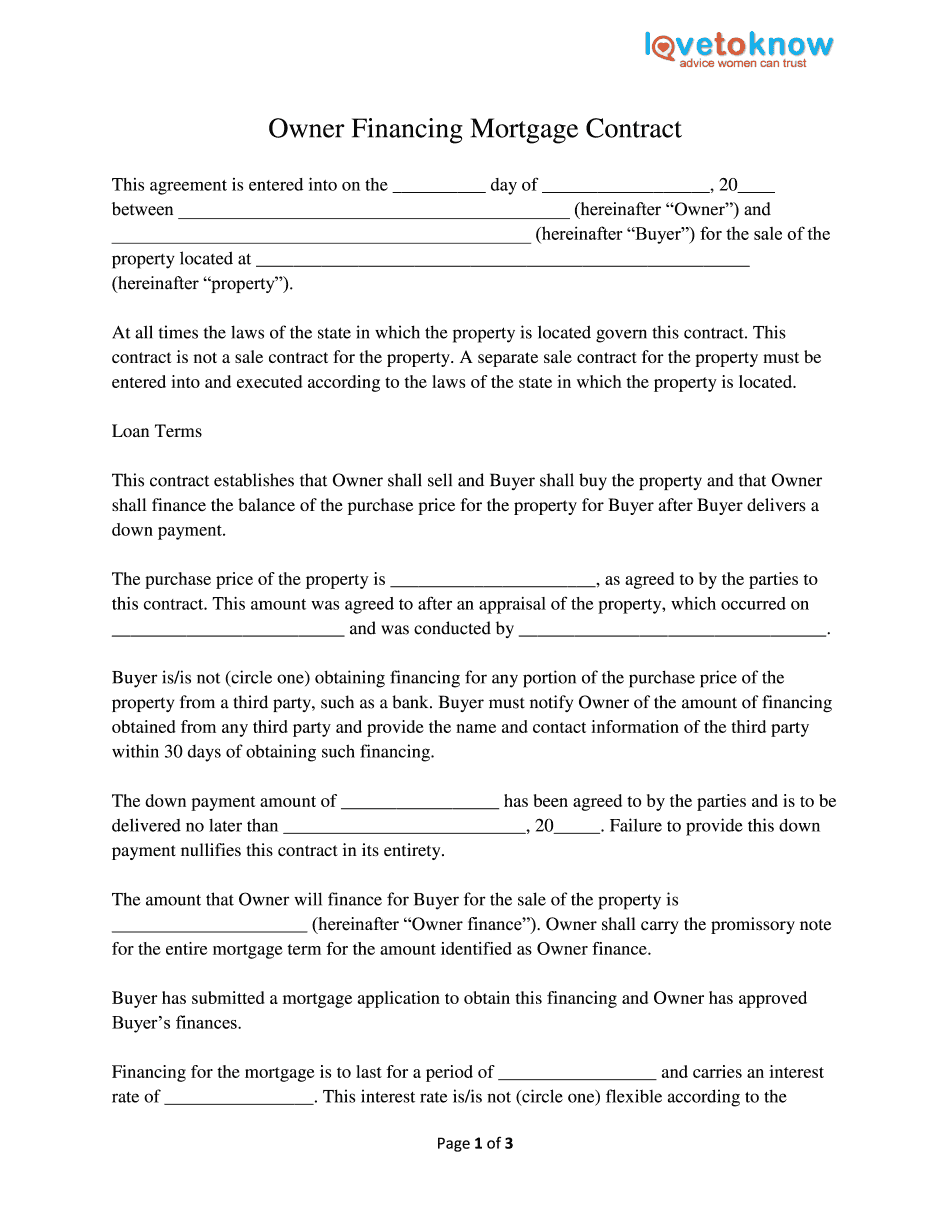

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Owner Financing Mortgage Contract, steer clear of blunders along with furnish it in a timely manner:

How to complete any Owner Financing Mortgage Contract online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Owner Financing Mortgage Contract by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Owner Financing Mortgage Contract from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Is Owner Financing a good idea