Award-winning PDF software

Owner Financing interest rates 2025 Form: What You Should Know

Interest is charged on this amount. Mortgage insurance and property damage insurance may be part of the mortgage. Conventional mortgages often come with fixed payment periods and an interest rate that is not guaranteed or tied to a number. How to Buy a Place — Bank of Canada Sept 28, 2025 — In the United States, real estate buyers can buy a home with 20 per cent down; that is, with 25 to 30 per cent equity in property and not all the principal of the home. In Canada, this is not permitted. The only home that can be sold with 20 per cent down—and the only loan that can be obtained is a “conventional” mortgage or one that comes with minimum down payment of 20 per cent, in which case the lender's maximum lending limit would be 20 per cent. Conventional mortgages can be more costly. The interest rate will be higher than a “conventionally guaranteed mortgage” and the minimum down payment will not be the same. Even though the interest rate is higher, home prices rise faster and more quickly, at times outstripping the 20 per cent home equity. Also, the interest is higher when you need it. What is a credit card interest rate? Nov 1, 2025 — Rates for credit card debt (excluding debt you can repay from income) are set by a federally appointed authority. An interest rate of 12 per cent is the national average. Some credit cards offer “non-compete” clauses which prohibit you from opening an account or card with the same issuer for a period of time. Credit Card Rates — Bank of Canada May 29, 2025 — Credit card rates were set at the beginning of 2025 and may go up or down from there. A lot of interest rates are tied to where mortgage rates are. How to Buy a Place — Loan Calculator Sept 23, 2025 — What is an interest rate for the purchase of the entire home, not including capital improvements? Interest rates are based on loan-to-value ratios (TVs) and are set by a federal appointed authority, which has a range of interest rates that are competitive. Mortgages can be fixed or variable, but a fixed-rate loan is most common. In a variable rate mortgage you can change the rate every year or month. Fixed-rate mortgages come with certain criteria to qualify, like credit worthiness and savings.

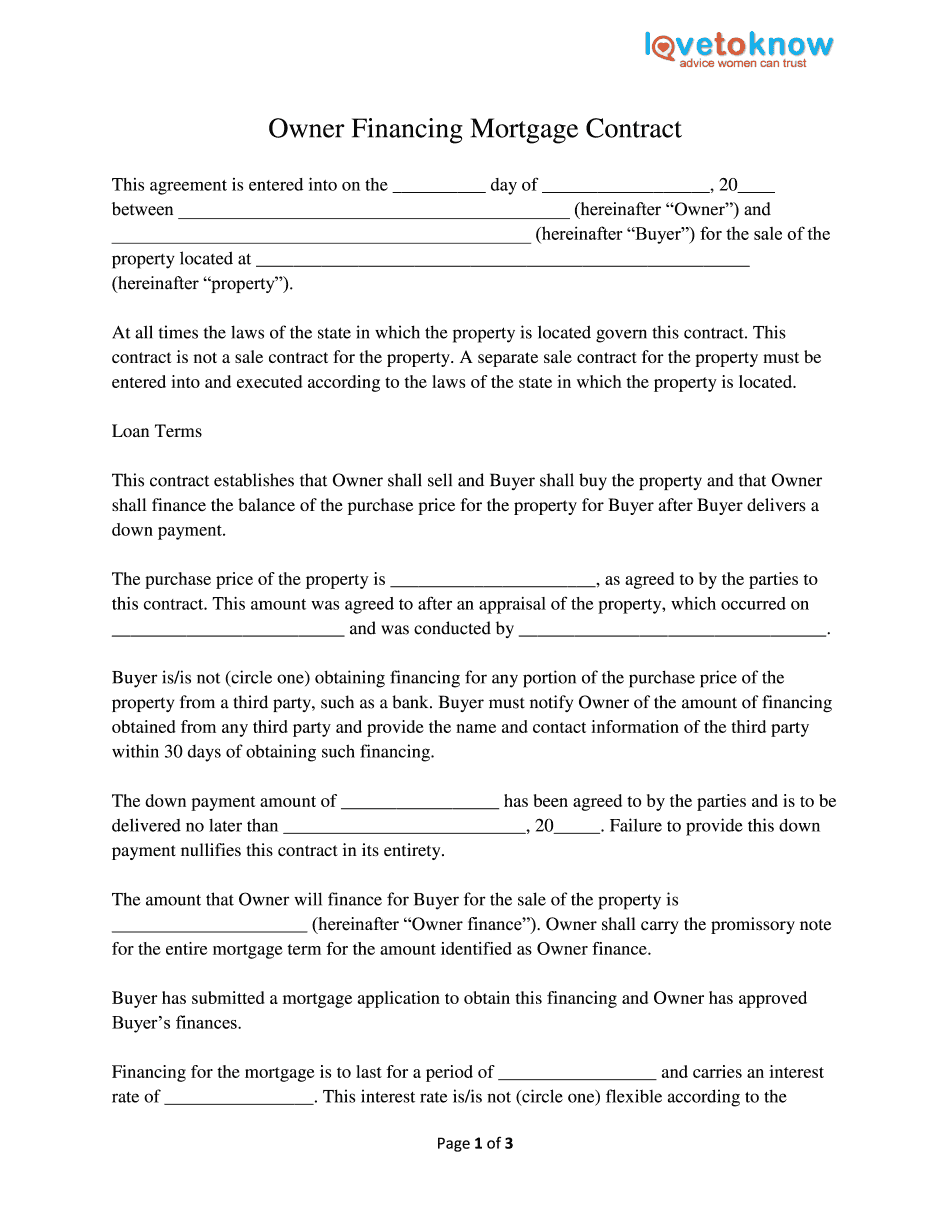

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Owner Financing Mortgage Contract, steer clear of blunders along with furnish it in a timely manner:

How to complete any Owner Financing Mortgage Contract online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Owner Financing Mortgage Contract by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Owner Financing Mortgage Contract from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.