Hey, what's going on guys? It's Sam, co-op one of the Coop brothers, real estate investors. Today, I'm gonna show you how Danny and I generally negotiate and find owner financing deals. Now, this is very exciting because this is actually our first time showing you guys some of our secrets online on YouTube and Facebook. So, I was kind of worried at first because I'm gonna be sharing some of our secrets and what makes us competitive as real estate investors and how we negotiate for deals. In a general sense, I'm not gonna share everything, but I wish to share some big picture information that's gonna help you, definitely. Now, if you want some of the details and some of the more juicy stuff, I'm gonna leave some links and resources down below in the links section. If you're watching this on Facebook, you'll see it up top. I'm gonna leave the cheat sheet right, our owner financing cheat sheet, guys, you can download that for absolutely free. We have an owner financing calculator that's gonna show you and help you determine if what you're dealing with is a good deal or not a good deal. The cheat guide itself, we have a couple of questionnaires you can ask the seller, as well as seven deadly pitfalls to avoid when it comes to owner financing. Now, of course, if you guys are a part of our training program, you guys will have us as your one-on-one resource. You can message us, text us, and call us if that's something you want to do. I'll also include that down below in the links description, where if you guys are interested in our training program, we go over a lot of different real estate investment topics. So, you guys might notice our video...

Award-winning PDF software

Is Owner Financing safe Form: What You Should Know

The terms of the owner financing are determined by the property, seller and lender in an ownership-by-lender deal. Home buyers must know the laws and regulations governing owner versus landlord financing. Are home buyers responsible for paying any property taxes or insurance on an owner-financed mortgage? A Guide to Owner Financing: Pros and Cons of Owner Financing Apr 9, 2025 — When it comes to selling an ownership-by-lender, homeowners can either mortgage the property directly, or sign a deed of trust with a lender. Both the first two options put the property at the owner's disposal on terms of his or her choosing. Who owns the deed of trust on an owner-financed house? Is there a difference between a deed of trust and a mortgage? The basics of a deed of trust and mortgage. What do mortgage and deed of trust loans have in common? The key to understanding both and understanding them for your own home can save you trouble when signing up. Read on for information on an investor's mortgage A Guide to Managing Your Home Loan May 17, 2025 — Here's why it's essential to read your loan terms carefully before deciding whether you'd like to buy a home. Read these guidelines and keep an eye on your mortgage. When you buy a home, how do you pay for it? If a homeowner signs a mortgage agreement, do they then have to pay any property taxes and insurance on it? How much of your home can be mortgage-driven to make the purchase affordable? Owning a home and paying property taxes, insurance, and property development costs. When you buy your property, do you have to agree to maintain it in a certain condition for the life of the mortgage? Home buyers and home-owners often agree to a long-term mortgage, giving rise to the term 'mortgage on a home.' For instance, a monthly mortgage will likely continue on a home for at least 40 years. When it comes to the terms of the mortgage, the property developer is the seller and the homeowner are the buyer. But when you sign a mortgage, you're buying your property as a mortgage-driven asset. A Guide to Managing Your Home Loan Apr 4, 2025 — If a home buyer signs a mortgage, the seller is the buyer and the homeowner are the seller.

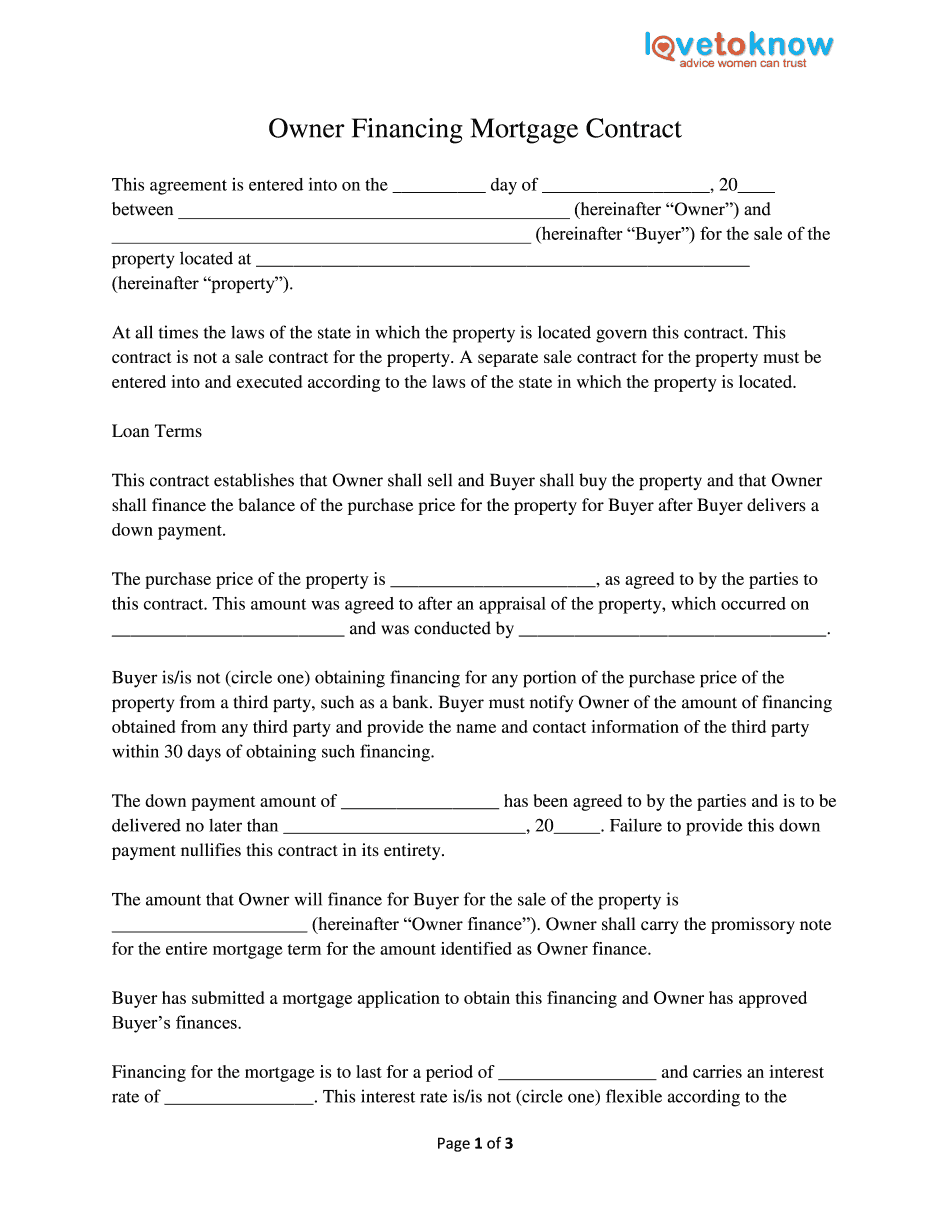

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Owner Financing Mortgage Contract, steer clear of blunders along with furnish it in a timely manner:

How to complete any Owner Financing Mortgage Contract online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Owner Financing Mortgage Contract by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Owner Financing Mortgage Contract from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Is Owner Financing safe