Hi, it's Chad C from C real estate here in Richmond, Virginia. This week, I want to talk to you about a topic that applies to a relatively low percentage of our population. However, in certain circumstances, it can be an important one that people will appreciate learning about, I suspect. That topic is the idea of owner financing. Every now and then, I'll put a house up for sale or be talking with someone who perhaps owns it as a rental property. Maybe they own multiple rental properties and are in their later years, wanting to liquidate their real estate investments. However, they are concerned about the tax liability they'll have, specifically the capital gains tax, upon selling those properties. One remedy or option that can soften that blow, if you will, is the idea of owner financing. Instead of selling the property for all cash at once, the property owner can sell it to someone and finance it themselves. They can then allow the buyer to make monthly payments, perhaps with a sizable down payment. This approach can lessen the tax burden and provide the seller with more time to consider their next investment. Not only that, but with owner financing, the seller can potentially earn a higher interest rate than if they were to receive all the cash at once and invest it in a bank. By receiving monthly payments and keeping a claim on the property, the seller has the ability to foreclose and resell if the buyer stops making payments. This allows them to continue earning a higher rate of interest without the same tax liability they would face if they had received all the cash upfront. Of course, it is important to consult with a CPA and a good attorney to properly structure the terms of the financing...

Award-winning PDF software

Tax benefits of Owner Financing Form: What You Should Know

Interest and Dividends Report, after your home sale. The Form 1098 also contains information about mortgage interest on the property. This form is used to verify that the owner of the property actually paid the original loan amount and the actual interest rate for the property. How To Make The Most of Owner Financing Selling real estate and getting rid of a mortgage is an investment, but at what price will you see a gain? In the process of purchasing or selling an investment property, the amount of capital gain can be substantial. The Internal Revenue Code (IRC) treats a property as your capital asset if your investment-related income is greater than your adjusted gross income. This means selling or moving the home or other related real estate in its current location would exempt you from capital gains tax. However, even if the tax code says you don't have to recognize capital gains (because your income is higher than your AGI), in reality your tax bracket depends on when you make the sale. You can determine the current tax bracket for your residence by the tax treatment of capital gains versus inflation. For more information about capital gains tax, see the IRS website at [link]. Buy or Sell Your Own Home If you're the owner, you can't simply write a down payment, pay a broker to buy or sell a house, and have him or her write the remaining amount off each year. You need a bank, real estate agent, or other financial institution to take the risk on purchasing your home or refinancing it. The process of buying or selling your home will take more time and money. You will need a real estate agent with experience buying and selling homes. The seller must have good credit, be selling a different property than you bought it from, qualify for a loan, and be willing to spend more money on their home. If you want to borrow the money to buy your house, you will take a loan and interest payment. Some lenders charge a 3% or 6% down payment. Other lenders will make the down payment equal to the balance when you enter into the contract. How Much Is The Down Payment? The down payment, the down payment interest, and the final mortgage payment are one part of the total cost of buying or selling your home. Before you sell your home, the seller will have to pay off the outstanding principal balance.

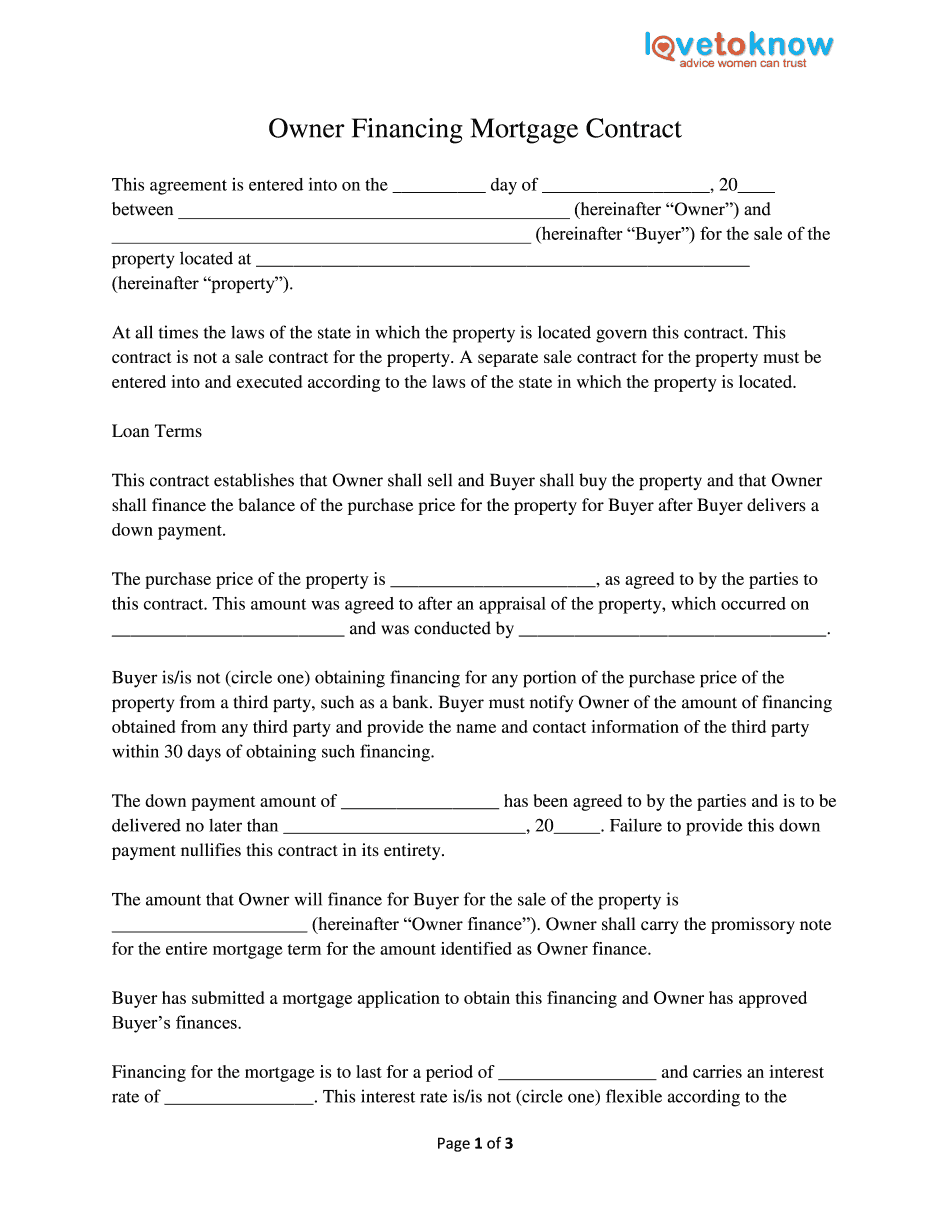

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Owner Financing Mortgage Contract, steer clear of blunders along with furnish it in a timely manner:

How to complete any Owner Financing Mortgage Contract online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Owner Financing Mortgage Contract by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Owner Financing Mortgage Contract from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Tax benefits of Owner Financing