All right, Texas law of contracts is what I just finished. I also completed the Texas law of agency. I treated the Texas law of contracts in a similar manner as the Texas law of agency. Many concepts covered in the contracts course served as a review of earlier chapters. It is closely tied to the principles of real estate in Texas. I quickly went through the material, starting on November 30th and finishing on December 18th. There were some days when I didn't study it at all. My method involved using a computer program to read the text out loud while I followed along. This sped up the learning process for me. I could even change the voice tone to suit my preference. Despite the confidence gained from previous exposure to the material, I still ensured I thoroughly reviewed any unfamiliar or forgotten concepts. I relied on online quizlets and quizzes between chapters, as well as the final exams provided. I also utilized the study book that came with Express Realty, where I marked and highlighted important information. This approach allowed for a quick review. However, during the test, I encountered some questions that were unexpected or unfamiliar. As a result, my score was a 71, just passing. I recommend going back and writing down any challenging concepts to review them before moving on to the next topic.

Award-winning PDF software

Contract for deed texas Form: What You Should Know

Get PAIN and Be a Tax Preparer — Ultimately Renew in Person at The U.S. Postal Service Taxpayer Assistance Center — San Francisco 3 Sep 2025 — The U.S. Postal Service Taxpayer Assistance Center will accept your PAIN for tax return preparation between the hours of 8 a.m. and 4 p.m., Monday through Friday. Tax return preparation is also available during our public hours at the Taxpayer Assistance Center, 515 Folsom Street, San Francisco, CA 94103. We know that your busy schedules and busy lives can be stressful. If you want the best online tax process and customer service, we would recommend you give our PAIN renewal service a try. The IRS encourages all taxpayers to make the effort to renew the personal exemptions on their federal tax return, as well as to obtain the social security numbers that will be needed for a refund, if any, and any new credits that may apply. If you are already in the process of doing so, you should take a moment to review the information below. While this is no longer required when processing your W-4, we recommend you remember the date by which you must renew. The tax return deadline is March 15th if you filed the original return (including the W-4 that is used to calculate your federal income tax liability), or March 16th if you filed Form 1040X and Form 1040 with a self-employment income of 400,000 or more. The deadline is March 15th if you filed Form 1040 with a self-employment income of 250,000 or less. If you haven't yet updated your information and want to renew your PAIN, you will be automatically enrolled in PAIN Online if you do not choose otherwise on that year's tax return: The IRS will automatically email your employer about this information, or your tax practitioner will advise you. A reminder of the tax-related changes to the 1040X and 1040: The tax-related changes that affect 1040X and 1040 can be seen HERE. This list gives the most important changes, but there may also be small changes that are applicable to you. This list will likely be updated as we discover other important changes or updates. You may be interested in this list of Tax-Related Changes to the 1040X and 1040. The current federal income tax withholding tables are available HERE.

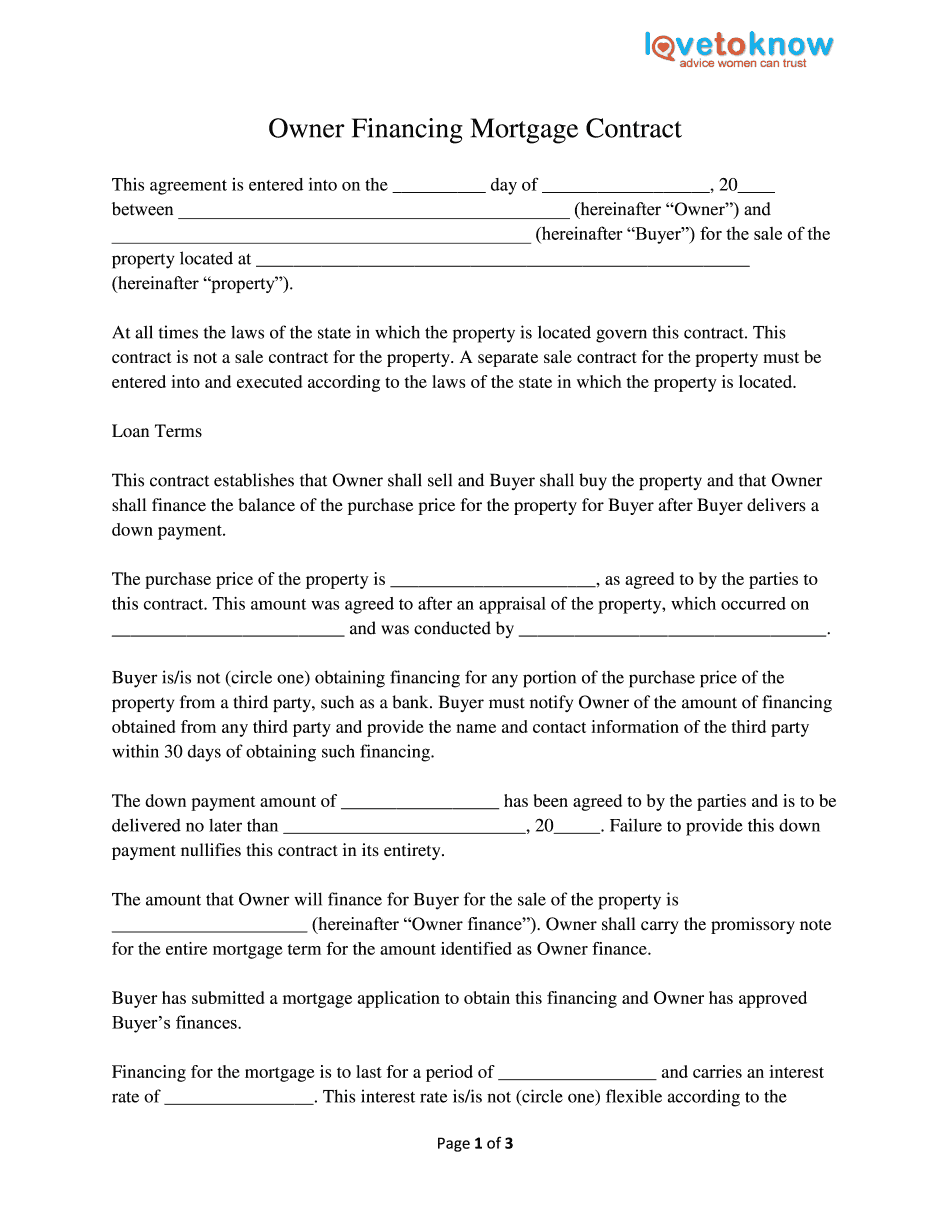

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Owner Financing Mortgage Contract, steer clear of blunders along with furnish it in a timely manner:

How to complete any Owner Financing Mortgage Contract online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Owner Financing Mortgage Contract by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Owner Financing Mortgage Contract from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Contract for deed texas