Award-winning PDF software

Pitfalls of seller financing Form: What You Should Know

Things to Remember When Buying a Real Estate Property in Noida | Noida Crow Legal If the buyer pays off the note before the purchase, in many cases, you will need to pay a penalty fee to the seller as 'premium' for agreeing to the note that you are 'selling' to you. In addition to paying a cash price for the property, and/or selling the property, in many cases you will pay sales taxes and brokerage commissions. In some cases, sellers in Delhi may make a 'tax on disposal' as part of the purchase price — as a 'incentive' against getting a better price Apr 18, 2025 — Pros: It is easy to sell your home with the minimum of fuss. Most transactions can be completed within 30 days of the notice period. This is because the buyer There are very few things that you need to consider when planning to sell your home. A little of planning by both the buyer and the seller How to Sell Your Home in Noida (Delhi) | NADER Learn about all things to consider when you want to sell your home in Delhi. This article was written especially for those who are thinking about selling their homes in Noida, Delhi. Noida is not a small town, and many have a hard time getting their houses sold. Dec 17, 2025 — Pros and Cons of Seller financing for the buyer: In case of Seller financing, the buyer has to sign a contract to buy a property Buyers have to pay a down payment. As a result, the buyer will need to put in more money Buyers pay a higher interest rate than a bank mortgage in India. However, the interest rate can be reduced as per the terms of the loan, or the seller can increase it. Buyers will also have to make payments towards the property Buyers are less worried about their personal security if they pay in cash (and not get forced to make cash payments during the sale process). However, if the seller is more confident in the buyer, the buyer can be more inclined to take a mortgage because the seller will be more relaxed about the home. Sellers can also require the buyer to secure a bond before accepting the deal.

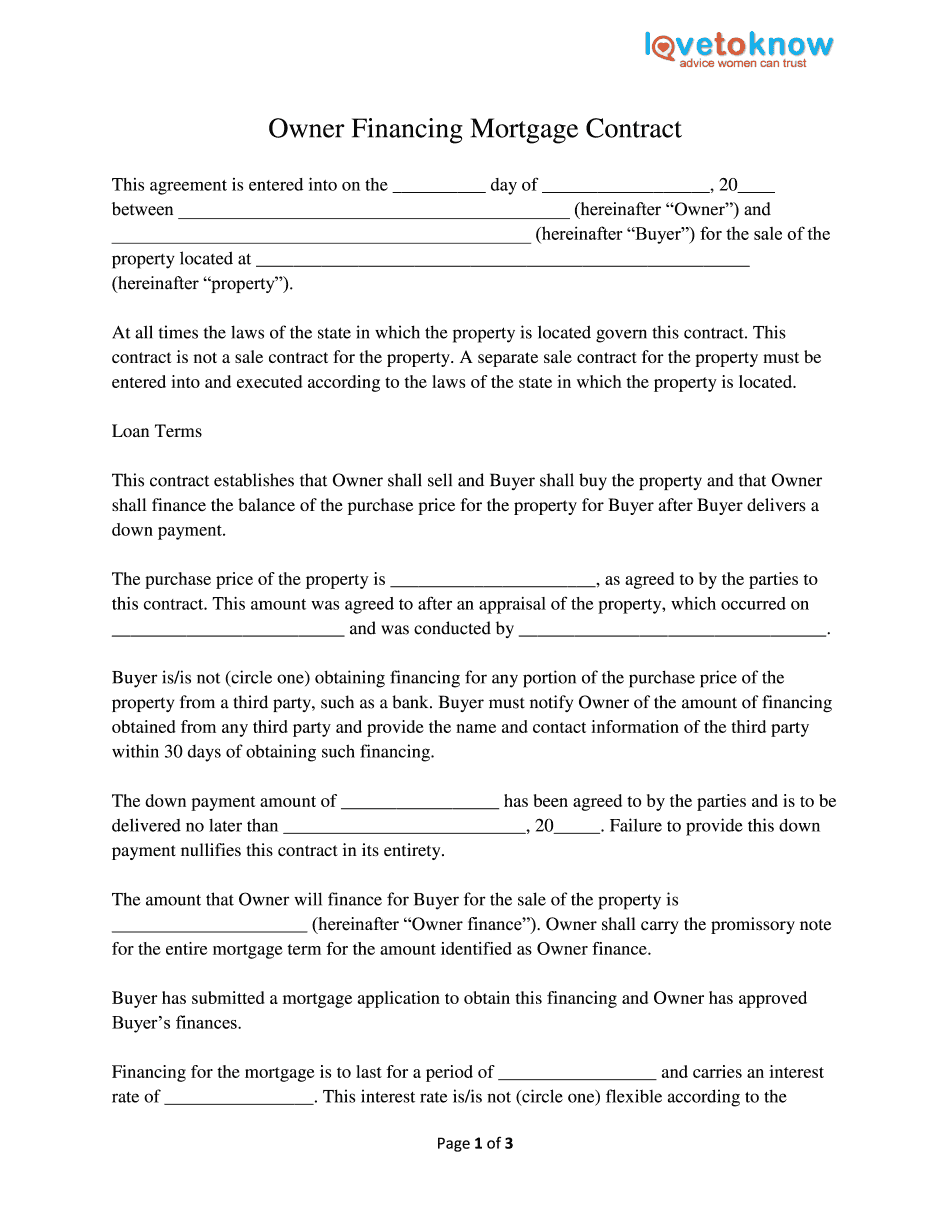

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Owner Financing Mortgage Contract, steer clear of blunders along with furnish it in a timely manner:

How to complete any Owner Financing Mortgage Contract online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Owner Financing Mortgage Contract by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Owner Financing Mortgage Contract from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.