Award-winning PDF software

Owner financed homes no down payment Form: What You Should Know

The charge is non-refundable. The fee shall be assessed on or before the due date of payment. Example: On April 1, 2018, the first installment is due. Payee (Lender) is the party named on the Note. LATE CHARGE: The note holder shall be entitled to collect from Lender an administration fee of a minimum of 5%, as provided in this Agreement. The charge shall be assessed on or before the due date of payment. The admin fee is non-refundable. The fee may be collected by the administrative officer appointed hereunder. Example: On April 1, 2018, the first installment is due. Payee (Lender) is Lenders, Inc. (the “Lender” or “Lender”), the entity acting as Lender's agent on their behalf and on that of Seller. The check is payable to “Lender” and is not payable to the Seller. On April 2, 2018, Payee attempts to collect the fee by delivering a note payable to Lender to the Seller, and Lender refuses the note. Payee does not have sufficient funds to pay either the note or the administration fee, and attempts to collect the fee by delivering a second “check” (the second notice to the Seller) instead of a check. Note is payable to “Lender” and is not payable to Seller. Lender is not a party to this Agreement as the Lender has not been the seller in this transaction. Lender has not been the holder of the Note; however, Lender may agree, upon notification by Seller or Payee to pay the note as owner on the next due date of each month, but only if Lender does not receive more than 20% of the payment on any month by the due date of the next payment. Notice will be received by Lender at least 20 days prior to any proposed late charge to the Seller. A proposed late charge shall be based upon the number of days that should pass without payment of any amount owing, without including any fees, interest or penalties and excluding any interest or penalty that may be imposed in the absence of the penalty set forth in section 1. A of the agreement of Lender and Seller.

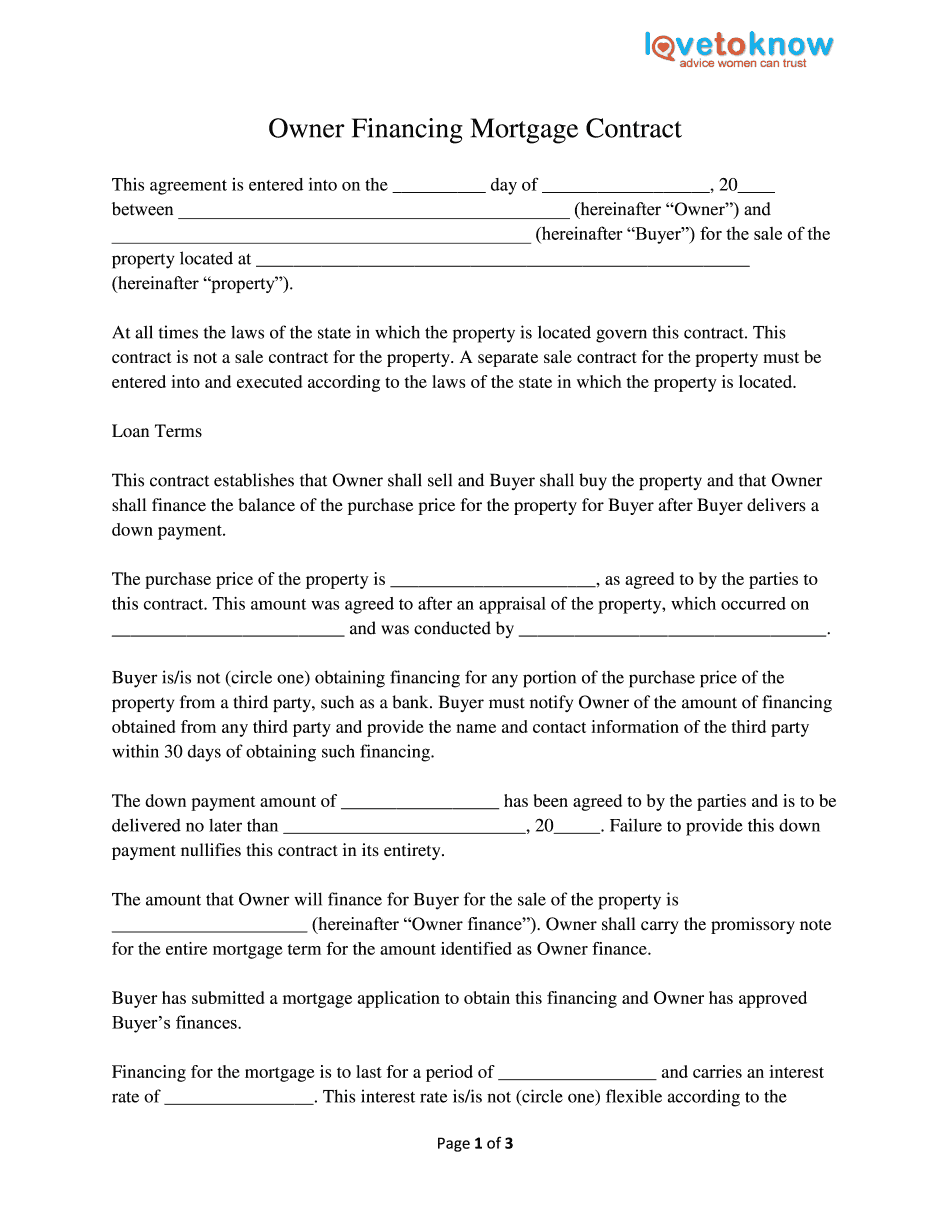

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Owner Financing Mortgage Contract, steer clear of blunders along with furnish it in a timely manner:

How to complete any Owner Financing Mortgage Contract online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Owner Financing Mortgage Contract by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Owner Financing Mortgage Contract from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.