Okay, let's move on to our second creative financing strategy, which is the owner carry or seller carry. Now, what we're looking for is a seller who owns a property free and clear and is willing to accept most of the purchase price in the form of financing. That means you give a small amount or very little down, and the seller takes a note for most of the purchase price. This note is collateralized or secured by a mortgage or deed of trust against the property. So, you would get title to the property, the seller would get some money, a note, and collateral as a lien against the property. Ownership would be in your name or the name of a trust or LLC that you set up, and the seller would have a lien against the property. If you don't pay on the note, they can foreclose it under state law. Now, typically, when I make an offer to a seller who has a free and clear property (and by the way, you might be wondering who has a clear property these days, everybody's mortgaged up to their eyeballs), the reality is 31% of America is free and clear. Nearly one-third of properties don't have mortgages against them. By the way, can you buy a list of properties that are free and clear from public record sources that you can mail to and propose an offer? Absolutely. So, if you come across a seller who's free and clear, typically, I like to make two offers on such a property. The first is going to be a lowball cash offer, and the other one is going to be a terms offer. Typically, the cash offer, depending on the work the property needs, but typically, is going to be in the range...

Award-winning PDF software

Owner Financing homes Form: What You Should Know

Printable Owner Financing Agreement Template. Formal. • Printable/Downloadable Owner Financial Documents • Buyer Financial Form (Check/Money Order, Certified Check, Money Order, Credit Card, Wire, PayPal, Visa, MasterCard, Discover) • Buyer Signature • Buyer's Signature (Copy and paste on front of Owner Financing Application Form) Ownership Form PDFs by Zip file Use the printable template to create an easy form to obtain a mortgage or deed of trust for a loan; or to buy property without a mortgage Fees for Seller Financing Purchase Agreement Buyer Signature Payment • Buyer Signature (Copy and paste on front of Owner Financing Application Form) Payment to Seller in full by check or transfer; • Send check; • Send cash (US currency); • Pay with PayPal, a third party payment service. This includes online payment sites, such as PayPal.

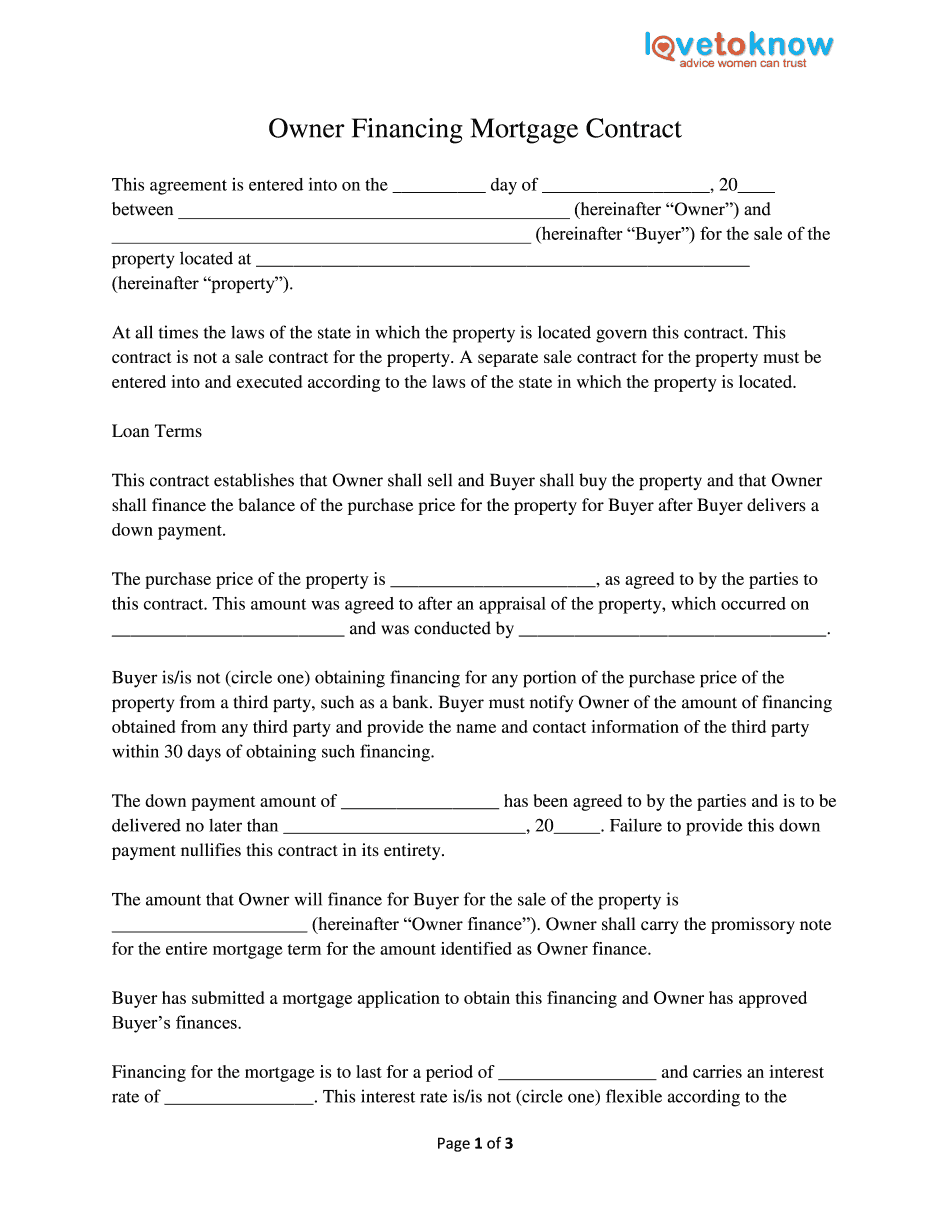

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Owner Financing Mortgage Contract, steer clear of blunders along with furnish it in a timely manner:

How to complete any Owner Financing Mortgage Contract online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Owner Financing Mortgage Contract by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Owner Financing Mortgage Contract from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Owner Financing homes