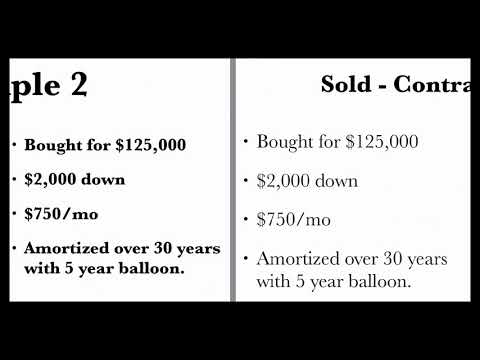

Hey there bootstrappers, this is Ryan Nichol, and welcome to Bootstrap REI. This is another training, part 2, on how to build a cash flowing empire using seller financing techniques. I'm going to share with you several examples to give you an idea of how to structure a deal and also what to look for in your deal analysis. So, let's go ahead and get started. Here's an example scenario: you find a house where the seller owes $177,000. The repair value (ARV) of the property is $185,000. It needs $3,000 to bring it current because it's currently in arrears. Additionally, it needs about $1,500 worth of work, and the monthly payments are $1,240, including principal, interest, taxes, and insurance. It's a two-bedroom, one-bath property, and the fair market rent for a two-bedroom, one-bath in this area is $1,100. Now, the question is, is this a deal or not? Take a moment to think about it and write down your answer or come up with one in your mind. Alright, the answer is yes, this is a deal that I did. I bought this property subject-to, meaning it was deeded over to me, and I sold it for $195,000. You may wonder why I sold it for more than the repair value. Well, when you're financing things through a lender and getting an appraisal, the loan amount cannot be more than the appraised value. However, when you're selling with seller financing, you control the terms, so you can sell it for more. In this case, I sold it for $195,000 with $18,000 down, $1,400 monthly payments, and a $1,500 work credit. My profit on this deal was $13,500 plus $200. Now, you may be confused about the math here. If I received $18,000 down, how did I only profit $13,500? Well, I gave a $1,500...

Award-winning PDF software

Seller financing business Form: What You Should Know

Inventory — ineligible asset for installment sale. Gain on sale of inventory — less than depreciation recapture, report fully in year 1. I, the undersigned, hereby certify before you that each of the statements in Section 4c-a of this report is true and correct to the best of my knowledge, believe, and judgment. I hereby declare pursuant to the requirements of Federal law that I have examined the statements in I, the undersigned, hereby declare under penalties of perjury that I have examined the documents and have been I, the undersigned, hereby certify under the penalties of perjury that the foregoing information is true and correct to the best of my I, the undersigned, hereby certify as to the undersigned's qualifications and knowledge, pursuant to 18 U.S.C. Section 1001, that the undersigned is qualified and can answer all the questions posed in the above statement. I, the undersigned, further certify that under the laws of the United States of America that I am not a United States Government employee. Furthermore, I, the undersigned, hereby certify that I am not a United States Government contractor who is prohibited by federal law from receiving certain compensation. Furthermore, I, the undersigned, hereby certify that the foregoing information is true and correct to the best of my I, the undersigned, hereby certify under the penalties of perjury that I am qualified and can answer all the questions posed in the above statement, and that the foregoing information is true and correct to the best of my following information is provided by the Department of Labor based on data it has received from the United States Trade Representatives International Trade Commission (ITC). ITC Data on Exporters and Importers — January 2014 Estimated U.S. foreign direct investment (FDI) in nonresidential real estate for 2012 The United States recorded a net gain of 4.7 billion in 2025 on the sale of existing real property of 18.8 billion. This net gain represents a gain of 1.4 billion on U.S. real property exporters, 1.1 billion on U.S. real property importers, and 0.7 billion on U.S. real property investors. The largest percentage gains in 2025 were seen in Florida, Texas and California while the largest losses occurred in New Jersey. Estimated U.S.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Owner Financing Mortgage Contract, steer clear of blunders along with furnish it in a timely manner:

How to complete any Owner Financing Mortgage Contract online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Owner Financing Mortgage Contract by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Owner Financing Mortgage Contract from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Seller financing business