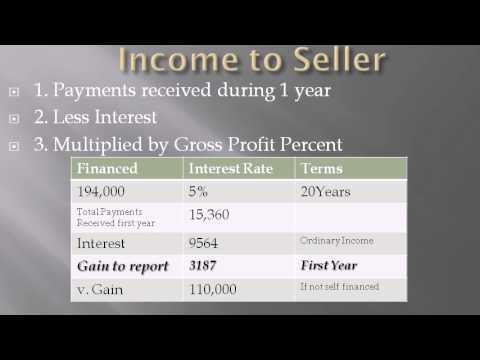

We see a lot of questions regarding installment sales of the priorities, so I'm just going to give you a brief example of what happens when a seller finances a property. Only the main home and the personal property qualify for this type of transaction. Basically, it's fairly simple. You just determine the gain to begin with and report the interest on your regular Schedule B. On the buyer's side, the same interest gets reported on Schedule A, which is tax-deductible. Next, we have to determine the return of purchase price and the gain on the transaction. For this example, we'll use the following numbers: sale price of $200,000 and purchase price of $90,000. The gain is $110,000. First, we have to determine the gross profit percentage. We take the gross profit of $110,000 and divide it by the contract price of $200,000. This gives us the gross profit percentage, which is important for the rest of the example. What becomes income to the seller in the first year is the total payments received during that year. Using the example I'm giving you, the financing takes place on $194,000 with a 5% interest over a 20-year term. The payment would be about $1,280. If we multiply that by 12, it becomes the total payments received during the year, which is $15,360. We have to subtract the interest from it, which is $9,564. Then, we multiply the remaining amount by the gross profit percentage. In this example, it is $3,187. If we were to report the entire transaction in one year, the entire gain of $110,000 would be taxable. Therefore, there are a lot of benefits for the seller to do self-financing or installment sales. As you can see, if the seller were to be in the 25% tax bracket, he would have to...

Award-winning PDF software

Who pays property taxes on Owner Financing Form: What You Should Know

What are some additional steps to keep on top of tax issues in an installment plan? — What Happens if Income From Property Tax Goes Against IRS Compliance Income and expenses to be reported on your installment agreements. What Are Special Tax Considerations for an installment plan? There are special rules to be involved for the installment sale of your principal residence. Form 1040 Schedule D Property Tax (Property) Sep 18, 2022 — Exemption from certain gross income tax. Exceeding limitation applies to taxable income and does not apply to net income. — Exemption from income tax on certain compensation that can be subject to federal estate tax. — Exemption from certain gross income tax for certain compensation that is income from a trade or business. — Exemption from certain gross income tax for amounts received from certain retirement plans. — Exemption from Federal unemployment compensation tax. — Exemption from State unemployment compensation tax. —Exemption from State tax on certain payments from public agencies for temporary or intermittent service that is compensated (including retirement benefits) under a collective bargaining agreement. — Exemption for payments, including nonqualified plan compensation, that can be taxed as nontaxable. Form 1040 Schedule E Schedule SE Sep 17, 2022 — Exemption from certain gross income tax on taxable income of the seller. Exceeding limitation applies to taxable income and does not apply to net income. — Exemption from other federal income tax. Exceeding limitation applies to taxable income and does not apply to net income. — Exemption from federal unemployment compensation tax. — Exception for the self-employed from estate tax. — Exemption from state income tax on qualified plan compensation. — Exemption for nonqualified plan compensation. — Exemption for amounts received from certain retirement plans. Form 1040 Schedule F Sep 17, 2022 — Exemption from Federal income tax on certain payments from the following: 1. Social security. 2. Railroad retirement and other retirement payments. 3. Public assistance or child support. 4. Military disability compensation, veterans' compensation or veterans' benefits. 5. Supplemental Security Income. 6. Supplemental Security Income (SSI). 7. Supplemental Security Income (SDI). —Exemption from other federal income tax. Exceeding limitation applies to taxable income and does not apply to net income.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Owner Financing Mortgage Contract, steer clear of blunders along with furnish it in a timely manner:

How to complete any Owner Financing Mortgage Contract online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Owner Financing Mortgage Contract by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Owner Financing Mortgage Contract from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Who pays property taxes on Owner Financing