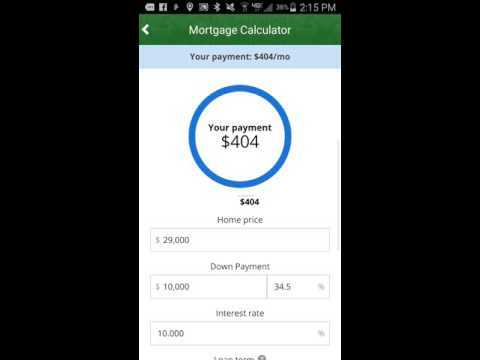

Hey guys, I'm going to quickly go over how to find seller financing terms using the Homes for 10k app. First, click on the app and it will open up. Then, click on the menu and scroll down to the mortgage calculator option. When you click on the mortgage calculator, it will open up this part of the app. Skip the part where it asks for your zip code and scroll down to the bottom where it says "calculate mortgage now". You will see that part, just scroll down. To find out the terms you are looking for, enter the amount of $29,000 for the down payment. You can either put the percentage or the actual amount. For the interest rate, we usually do seller financing at 10% to 12%. Click on the advanced drop-down and change the terms to either three, four, or five years. In this example, let's say we choose five years. Uncheck Texas if it's applicable. At the top, you'll see a bit low, which is the mortgage calculator telling you the monthly amount of $404. However, you can also see it here. This does not include taxes and insurance. Usually, if it's a seller finance, the owner will have landlord insurance in place, but if it's a lease purchase, you can get renters insurance. You can also change the term to 12% and change the payment to $423. Let's use a higher amount. For a bigger house at $279,000, let's say the down payment is $30,000, which is 10%. For the interest rate, let's put 5%. If there is already financing in place, it would be different. Assuming it's based on a 30-year mortgage, the payment would be much higher. Let's say the payment is $2,000 a month at 9%. With a $30,000 down payment,...

Award-winning PDF software

Owner Financing calculator Form: What You Should Know

In some cases, the seller also agrees to add the down payment to the final price. A seller-financed purchase requires no money from the seller (assuming that the deal is for the property only). Home Buyer Loans: Calculating Principal & Interest May 19, 2025 — Homebuyer loans provide short-term capital to help you finance the purchase of a home. Homebuyer loans, as opposed to purchase-and-sell loans, typically have lower interest rates and higher down payments than mortgage loans, and usually can be paid off easily within three to six years. Homebuyer lenders, such as Bank of America and Fannie Mae, are also required to maintain strict underwriting standards which prevent fraudulent or abusive lending practices. Also, when you apply for a homebuyer loan, you'll need to bring copies of your income tax returns (and your federal, state and local withholding) which you received from your employers. You should also provide a copy of your most recent W2 with gross pay and expenses and pay stubs from all your other pay periods. Housing Loan Calculator — Bank Rate Mar 15, 2025 — Use this mortgage calculator to calculate the monthly payment after down payments are factored in. Pay-Down Calculator: This calculator provides the monthly payments for two-unit homes purchased in the City of Pittsburgh.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Owner Financing Mortgage Contract, steer clear of blunders along with furnish it in a timely manner:

How to complete any Owner Financing Mortgage Contract online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Owner Financing Mortgage Contract by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Owner Financing Mortgage Contract from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Owner Financing calculator