Award-winning PDF software

What is seller financing vendee Form: What You Should Know

For both the original buyer and the seller who finances the contract, the buyer can borrow up to 150% of the cost of land as determined in an appraisal process. A lender may require an additional 5000 plus 20% fees to complete a land installment contract. Homeowners who purchase a property for less than 350,000 must finance half of the price with a VA Veda Loan and the other half can be financed with the VA Vendée Loan. What is the VA Vendée Loan? Mar 30, 2025 — The VA Veda Loan and VA Vendée Loan are two completely separate loans, with unique payment periods and terms that can be customized for each individual purchaser. How does the VA Vendée Loan work? This FAQ is here for information purposes only. The VA Veda Loan is just as it sounds, a VA Vendée Contract that can be used by the original buyer to finance the purchase of a VA VA-owned property. The term VA Veda Contract is used for the purchase of a VA-owned property not covered by the VA RED program. Why is the VA Valved contract so expensive? The VA Agenda Contract is paid for from the proceeds received from the VA sale of the VA property. The proceeds of such property sales are not a revenue stream for the VA, although they may be sold at a profit. The VA is not in the business of making money on the VA properties they oversee or control. In all but the most exceptional case, they are left with the property funds, at which point, the VA becomes the agent for the purchaser (the buyer of the VA property in this case). The VA does receive a very small amount of income from the fees associated with providing the Agenda Contract, but it is only a small proportion, only around 3-5% of the total sales proceeds. The VA must maintain a sufficient inventory of available VA properties to provide the purchaser when a Agenda Contract is presented for purchase. As a result, the purchaser generally has about a six-month wait for a Agenda Contract to come into effect. What's The Bottom Line on VA Agenda Contracts and Properties? For both the original buyer and the vendor, it is a cost-effective and convenient way to finance the purchase of a VA VA-owned property.

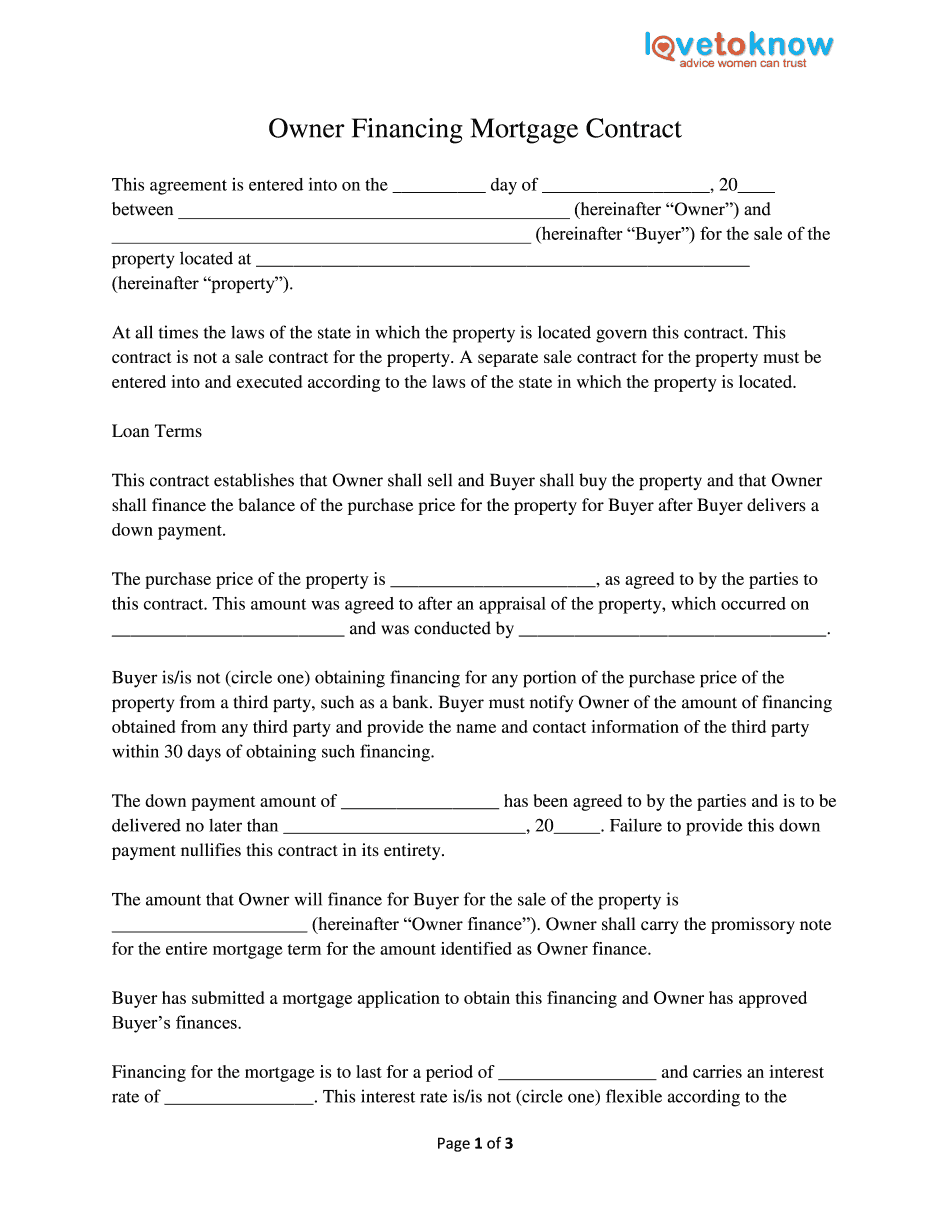

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Owner Financing Mortgage Contract, steer clear of blunders along with furnish it in a timely manner:

How to complete any Owner Financing Mortgage Contract online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Owner Financing Mortgage Contract by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Owner Financing Mortgage Contract from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.