Award-winning PDF software

What is a fair interest rate for seller financing Form: What You Should Know

Percent. The seller's mortgage lender, the seller's principal loan provider, provides a secured note for a balance of 147,250 and pays the seller 9.75 per cent interest for 90 payments over eight years. The owner also gives the seller a first, second, and third mortgage on the property. The third mortgage is secured by the property at a fixed interest rate of 6.875 percent. This interest rate, however, is higher than the minimum secured loan interest rate of 2.75 percent — and a maximum of 9 percent — required by the federal Homeowners Act for an owner-financed loan to be registered on the MHC database. In the example above, the buyer agrees to pay 15 percent of the purchase price up front, with the balance to be applied over the course of 90 months Buyer-Financed Real Estate Deals, What Can Be Done with the Financing Seller financing is one of the best ways to finance your purchase. It allows you to get an investment property before you make you down payment of 150,000, because you can always refinance the property up to 80 percent at the end and have an even better deal. The downsides are the same as those for buyer financing (see below). As an owner of an investment property, you have to sign the seller's legal consent forms to do this option. The buyer still needs to negotiate the deal with the seller. This is often how the seller ends up having no funds in the end to pay the lender back. One advantage is that you could sell without having to use this strategy because some sellers prefer that the seller hold onto the property while they make the down payment. You do need to negotiate the seller into allowing the home to be listed at your price, which will cost you 10 percent of the purchase price, while using this financing option. That means you'll have to pay a much higher price in rent to the property owner than if you just had a regular 200,000 to 300,000 down payment on the home. It's also very common for an owner mortgage provider to provide a buyer with an interest rate or interest rate guarantee on the seller's mortgage, which will be included in the final loan terms for the buyer. If the buyer defaults during the term of the loan, the seller (and mortgage lender) will be on the hook to cover the unpaid principal and interest.

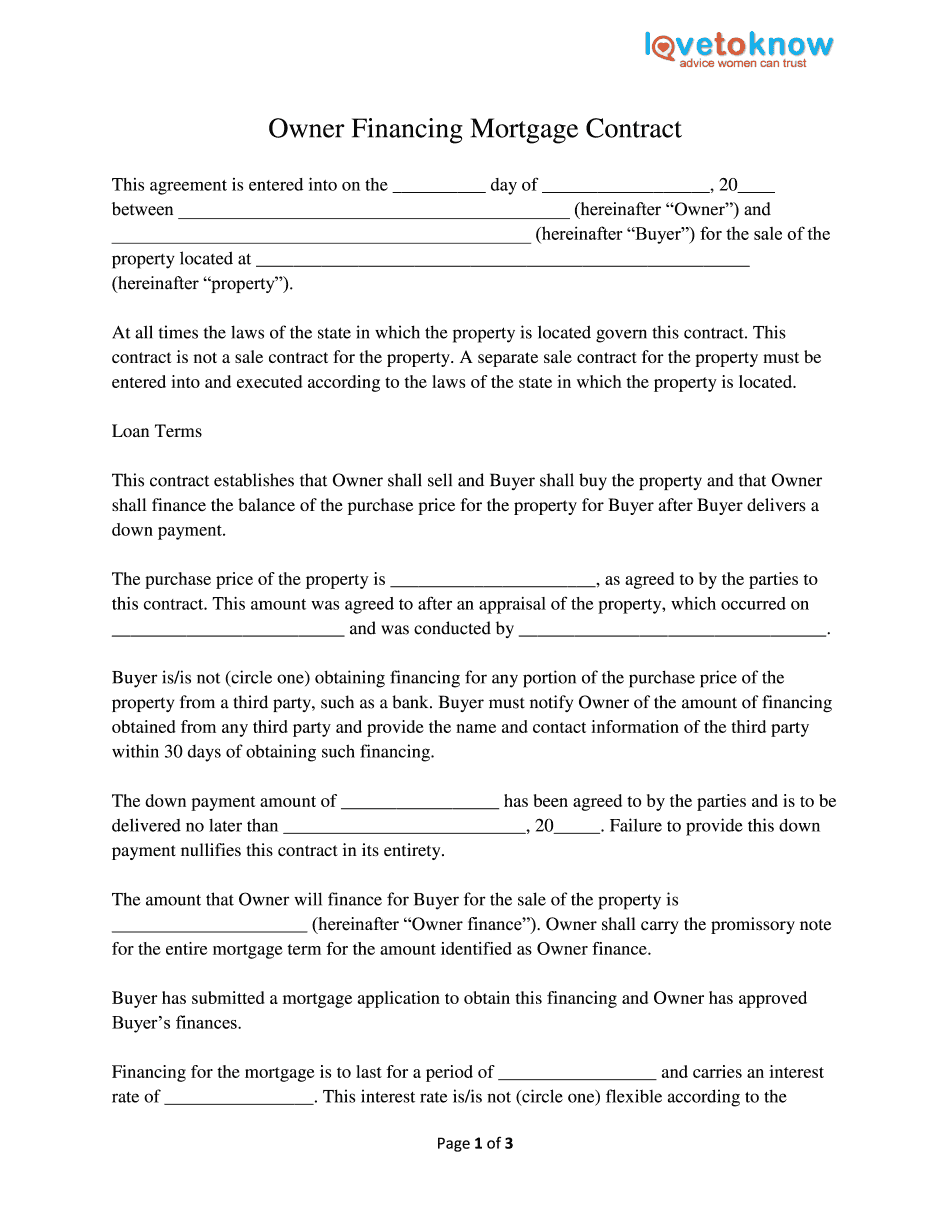

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Owner Financing Mortgage Contract, steer clear of blunders along with furnish it in a timely manner:

How to complete any Owner Financing Mortgage Contract online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Owner Financing Mortgage Contract by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Owner Financing Mortgage Contract from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.